Robin Khokhar

Robin Khokhar is an SEO specialist who mostly writes on SEO. Thus sharing tips and tricks related to SEO, WordPress, blogging, and digital marketing, and related topics.

Last week, Comcast saw a significant fund boost after Disney’s payment. They cashed in on selling its one-third share in Hulu to...

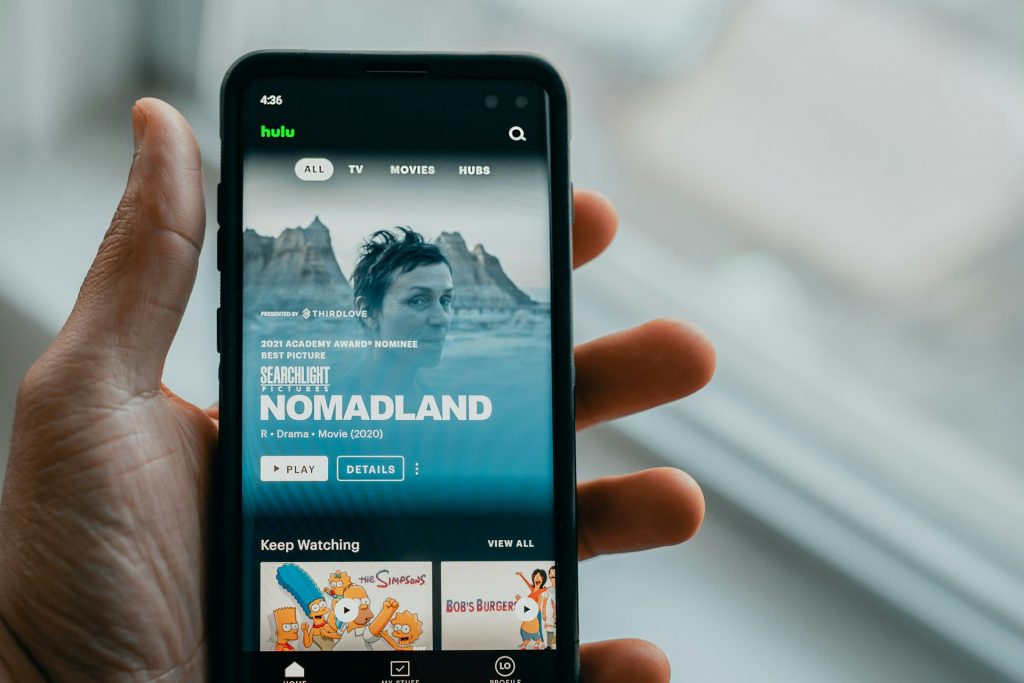

Image Credits: unsplash

Last week, Comcast saw a significant fund boost after Disney’s payment. They cashed in on selling its one-third share in Hulu to The Walt Disney Company. According to Comcast President Mike Cavanagh, they received an $8.5 billion check on Friday, December 1. It’s all squared away in the accounts. Cavanagh also hinted at a potentially even more lucrative outcome as the sales process continues.

A month after Disney’s payment revealed its plan to shell out at least $8.61 billion to Comcast’s NBCUniversal. It is for the remaining Hulu stake; news of the check clearance surfaces. This sum is based on a 2019 agreement setting Hulu’s floor value at $27.5 billion. However, Disney’s payment final price is anticipated to exceed $8.61 billion. In a deal with Comcast, an appraisal process was set in motion in September. They are considering Hulu’s tech platform, content, and bundling components. The results are expected by 2024, determining if Disney owes NBCU a percentage above the agreed floor value.

Brian Roberts, the Chairman and CEO of Comcast, has described Hulu as a rare and influential asset. He emphasized that it would attract significant interest if it were up for grabs in a regular auction.

Regarding Comcast’s broadband business, Cavanagh emphasized their commitment to achieving subscriber growth over time despite losing 19,000 subscribers in Q3 2023. He anticipates further losses in Q4 but refrains from specifying a turnaround date due to competitive pressures.

Cavanagh recognizes the competitive landscape, especially with fiber-to-the-premises (FTTP) and fixed wireless access (FWA) services impacting the lower end of the broadband market. While acknowledging the ongoing influence of FWA, he believes Comcast’s DOCSIS 4.0 upgrade positions them well against capacity constraints.

Highlighting fiber as a significant long-term competitor, Cavanagh notes that 50% of Comcast’s footprint faces fiber competition, a number expected to rise to 60% and beyond. Despite the competition, Comcast, after Disney’s payment, anticipates subscriber growth through expansions and opportunities from the $42.45 billion Broadband Equity Access and Deployment (BEAD) program.

With plans to pass an additional 1 million locations this year, Comcast sees potential for an increased annual pace, leveraging opportunities from the BEAD program for further expansion.

Recommended:

Global OTT Video Market is Projected to Reach 4.2 Billion Users by 2027.

GTA on Netflix: Unveiling the Release and Gameplay Experience