Michael Deane

Michael has been working in marketing for almost a decade and has worked with a huge range of clients, making him knowledgeable on many different subjects.

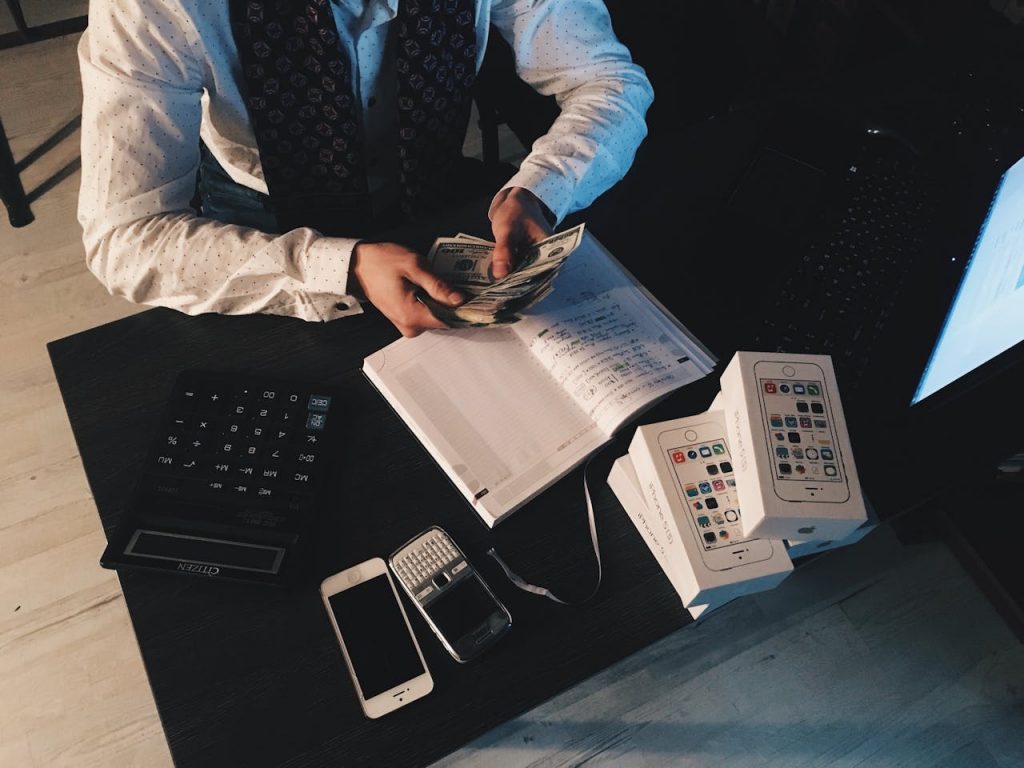

As a small business owner, you’re probably trying to cut your costs by handling all the tasks within your own and your...

Image Credits: pexels

As a small business owner, you’re probably trying to cut your costs by handling all the tasks within your own and your company’s resources.

But if there’s one task you’re considering delegating to a reliable expert, it definitely should be accounting.

If you’re wondering whether you need an accountant for your small business or if you can handle the finances on your own, this article will give you some answers.

The truth is, that some small businesses will succeed without an accountant. However, these businesses are in the minority. If you’re not sure which path to take, try asking yourself the following questions:

If you’re having any doubts about whether you’ll have the time or capacity to handle these responsibilities, hiring an accountant might be necessary for your small business. Here are the five most important reasons why.

When starting your own small business, there are many important decisions business owners need to make to create firm foundations for the future.

Accountants can help small business owners make informed decisions and minimize the risk of potential failure. Some of the main areas an accountant can help your small business at the early stage are:

The last thing a business owner needs at the start of their venture is to get stuck in problems with penalties and fines. A good accountant will help them avoid falling into such a trap.

Actions such as handling payroll payments, filing taxes, submitting accounts, and bookkeeping are sensitive matters. These issues need to be taken carefully and adequately to prevent problems with auditors and authorities.

For someone who is not obliged to follow the latest laws and tax regulations, keeping up with the latest changes can be challenging and confusing. With an accountant around and their knowledge of these matters, you won’t be facing such a challenge.

Your accountant will also help you stay on top of deadlines and save your business from paying money for fines, which you could put to much better use. They are also well-versed in saving money by identifying legal gaps or potential tax relief opportunities and filing your tax returns correctly.

You will be able to make the most out of your tax year and choose the most efficient tax planning options for your small business.

When your business is ready for growth, a reliable accountant can be one of your key advisors in developing your business plan. Accountants have a lot of experience monitoring cash flow, and they can identify profitable investment opportunities and put your funds to better use.

All the crucial decisions necessary for the development of your business, such as investments, significant purchases, or hiring new staff, will have fewer negative consequences if taken with the accountant’s support.

Accountants use reliable methods to consider your business options. This way, they are helping you best manage your resources and plan your financial strategies. Consequently, they can help develop your business without putting it at much risk.

Besides the benefits of a professional’s expertise and skills, there is another advantage many fail to recognize. Business owners sometimes get consumed by big ideas for boosting their profits and expanding their business.

But, since accountants are usually not directly affected by your everyday business activities, they can remain impartial. For this reason, their assistance is invaluable when assessing any plans and actions. No wonder 30% of SMBs regard their accountant as the most trusted advisor.

With the help of an accountant, you will find it much easier to calculate the risks your decisions might bring and their possible future effects.

When managing your small business, you have a lot of responsibilities on your plate. And chances are high – a limited budget.

Your first impulse will probably be to save money and manage the books yourself.

But, are you saving? Or are you wasting your resources?

Unless they are accountants, average small business owners practically pay themselves to manage tasks they have no expertise in. Their work is more prone to errors, and they need more time to complete these tasks, which leaves them less time to manage those that bring profits.

Delegating fiscal responsibilities to an accountant can save you time, energy, and money. Furthermore, you will avoid all the stress from working on tiresome tasks that you are not skilled enough for.

On the other hand, failing to acknowledge the need for professional support in handling your SMB’s fiscal matters can lead to negative outcomes and failure.

Suggested:

Useful Tips on How to Start a Small Business without Losses.

How to build a professional website for a small business?

Hey Michael!

Spot on with the info here. Any business gotta have an accountant or a few. A successful business runs off of successful number management and responsibility. It’s the reality, the fact that if you don’t take good care of your accounting, your success is short-lived.

Great article!

Thanks for sharing!

CHeers! 🙂